First Home Buyers

For over 20 years it has been difficult for first home buyers to put their foot on the first rung of the property ladder. The good news is that with the recent easing in property prices in Southeast Queensland and record low interest rates, it is a great time to take this first step. You will however, need to show the mortgage lenders you are able to service the mortgage, that you have a regular income and can meet the lender’s deposit requirements.

In recent months, lenders have tightened their lending conditions in response to pressure from APRA following the Royal Commission into banking. They are also factoring in the borrower’s ability to service a mortgage rate of 7.5% and requiring at least 20% deposit because of the down trend of housing values particularly in Sydney and Melbourne. There are however signs since the general election and APRA’s relaxation of the 7.5% rule, that the lenders are easing their criteria slightly.

The best approach is to shop around several lenders and pre-qualify for a mortgage as much as you can before you start house hunting. Establish what you can afford with the deposit you have and the mortgage payments you can afford.

If you can jump through all the hoops and buy well you may end up buying your own home with mortgage payments less than your rent.

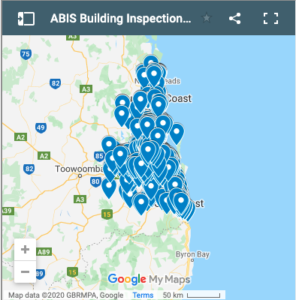

Don’t forget to have your ABIS building and pest done. This is not a time to have a nasty financial surprise after you move into your new home