Purchasing a home is a significant milestone and investment towards your future. Whether you are a young couple planning for children or an elderly couple looking for a smaller home to move into, finding the perfect house is not easy. The first step would be to ensure that you qualify for a home loan. Once you know that you are not blacklisted, and your credit score is looking good, you can visit your local bank or financial lenders to work out how much you can borrow from them.

Then you can start doing research on the different home loan options that are available to you and if they are the most suitable rate and features. This will give you a clearer idea of your financial status and give you the ability to find a home that is within your budget. If you have been saving up some money for when such a day when you would make a huge purchase came, you can use your savings as a deposit.

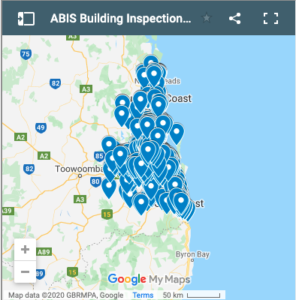

A significant deposit allows you to borrow more money and to apply for a loan that has a low-interest rate, meaning that you will pay a lower monthly mortgage. Another expense that is incurred when you’re buying a home is for things such as building and pest inspection whether the home is in Ipswich or anywhere else in the country.

There is also paying for the removals, application and registration fees and stamp duty among others. If the building inspection identifies certain details in the house that might need repairs, do factor those repairs into your budget for expenses incurred. Other houses need a tiny bit of tender love and care while others might need a second loan from the bank. Once you find the house of your dreams, make sure that you have all your paperwork, pre-approval from the bank and a deposit and start your bid.

You can also request the assistance of a broker or agent to assist you in each step you take to acquire your home for a smoother process. These tips should be able to help you understand the process better and ensure that there is no aspect of purchasing a home that you will forget.