For first-time home buyers, it begins to look like you are never going to get a chance to get a foothold in the market, and will be at the mercy of landlords, renting forever. Understandably, it is easy to get despondent when buying your first property, especially when you have limited financial resources. Always remember, the process of buying your first home is a marathon rather than a sprint where success favours the persistent and the resourceful.

If you are starting to feel worn down by the first home buying process, the most important thing you can do is to take a step back and regather your composure in the house-hunt. Reconsider your search criteria and evaluate your options:

Widen Your Search Parameter

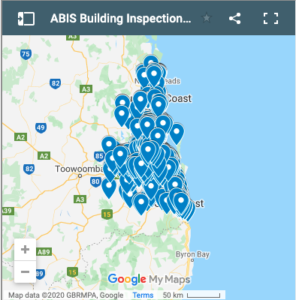

You may need to consider moving out of your comfort zone into an outlying area which demands a longer commute. Look for areas that are booming with residential and commercial development.

Start Small – Consider Simpler Properties

If you really want to live in a popular area such as the CBD, you could opt to start with a simpler and more basic property. For buying an apartment or a smaller house first that you can add value over time.

Compromise On Finishes

Properties that are dated, unsightly, unfashionable, or in need of repair and renovation could be a hidden gem. The worst looking house in the best street may represent an overlooked opportunity. Ensure you have a thorough Building and Pest Inspection because if the house is structurally sound, you might yourself a really good bargain.

Investment Property Versus Living In

You could consider an investment property, subject to legal advice from a licensed financial planner. Investment properties outside capital cities or in smaller towns or rural areas can have decent rental yields, making up for much lower capital gains. A positively geared property means you can build equity while your tenant repays your loan. When and if you decide to sell the property later on, you could use the proceeds as a deposit on a property in an area that was previously out of your reach.